Corporate Tax Day Today, Should Pull Down Reverse Repos To New Low

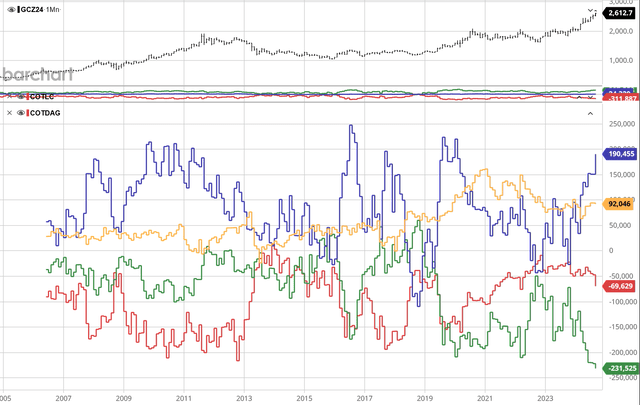

No short squeeze in gold yet, as short positions deepen further, probably to new record high as open interest surges 40K contracts last week.

Bullion bank gold short positions are off highs last week, but open interest is up 40K this past week, which means we are probably at a new record high.

The golden cross in gold and silver versus the S&P 500 is imminent, just like in gold.

Silver premiums have plummeted, indicating that the current rally is not sparking significant physical demand.

Rising delinquency rates in credit-card balances and China's economic struggles worsen, Chinese stocks at major support.

Bullion bank gold short positions retreated about 11K contracts to 231,525, but this is a week lag and open interest is 40K higher than it was last week on the price surge, and since about 75% of the net shorts are held by the bullion banks, we're probably at new records this week around the 260K area. See green line for where we are now.

A short squeeze has not happened yet. We would have had to see open interest falling into a rising price, but instead last week we saw it rising substantially into a rising price. Which means new short positions (and long positions) were opened at all time highs, which means the hole is being dug even deeper. This is a dangerous situation for both longs and shorts, since some crunch can and will crash the gold price (but a lot less than everything else as you know) so it's getting pretty high stakes now.

When net shorts get this high, usually there is a pullback, unless there is a squeeze first. See below:

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.