Core "Inflation" Zooms Higher, Sticky "Inflation" Still Highest Since 1984

Open interest in gold futures curiously climbs on the smash, very rare, and potential sign of a bottom just above $2,000

Core CPI reaches highest post Covid level since 1995, indicating rising consumer prices.

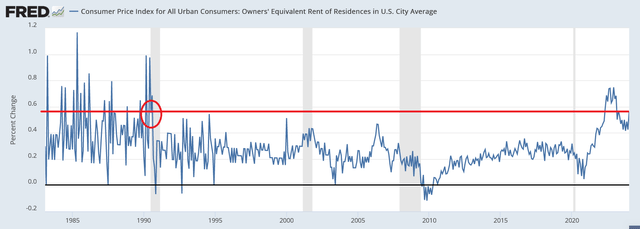

Owner's equivalent rent also at highest post Covid level since 1990, and sticky price inflation highest since 1984.

Open interest rises in gold on the smash, a rare move indicating possible bottom.

More on commercial real estate and the mortgage bankers association, the most riveting amazing association ever conceived by human minds.

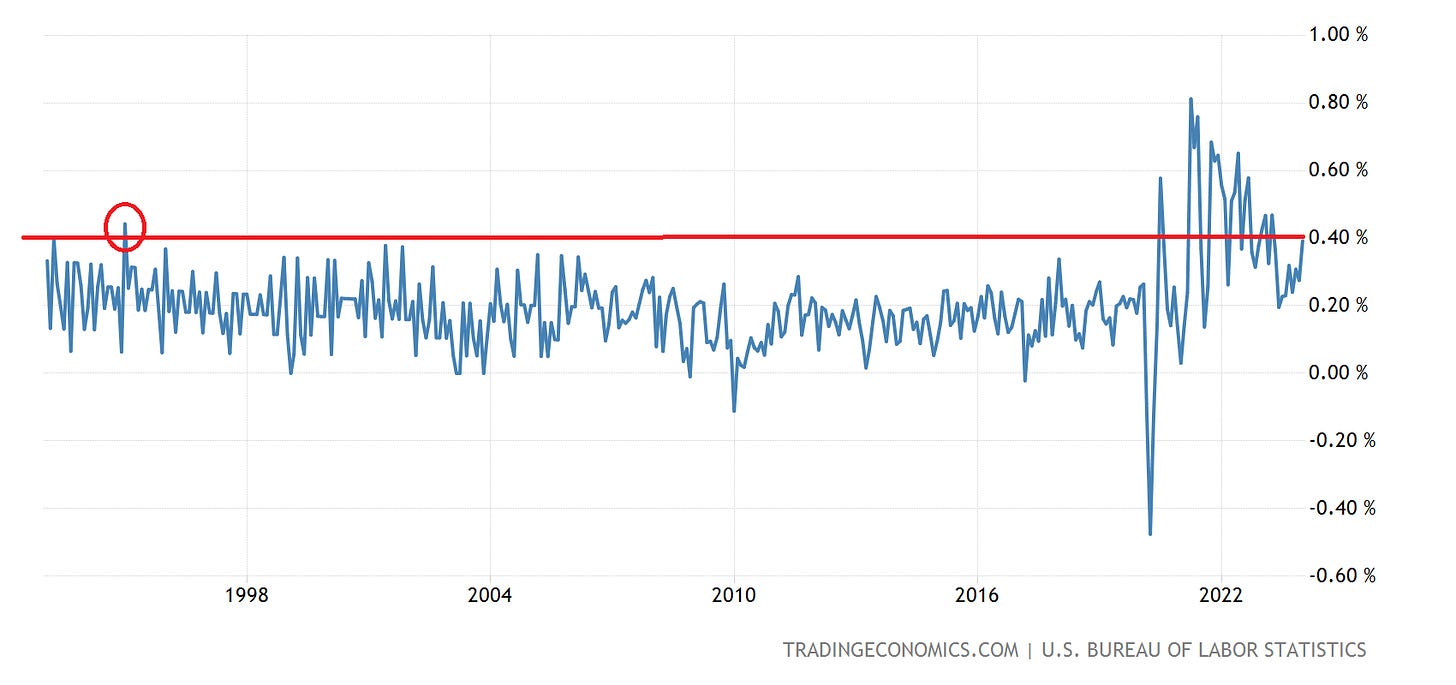

Core CPI (whatever that means) was up 0.4% since last month. That's the highest reading for any period pre-Covid since 1995, meaning 25 years. Consumer prices are on their way back up. It is pretty clear now. See chart below, core CPI MoM, and the red line I put in.

Another strong piece of evidence (on their terms at least) that consumer prices have turned a corner and we're on the next wave higher in what they call "inflation", is owner's equivalent rent, by far the biggest factor of CPI, and the stickiest. Month over month, it is also at the highest level since 1990, and headed strongly back up.

The StickyPrice inflation index, kajiggered by the Atlanta Fed, which measures the goods and services that change prices the least frequently, is stuck at 6.6%, the highest since 1984, the year we all love and reference all the time.

I know how this sounds, but hear me out. The fact that gold was smashed here along with asset prices across the board bodes very well for real money on the next financial crisis. I know that sounds annoying and the situation is very frustrating right now. But it is bearable, provided you are not leveraged. Logically, from what I see, what the smash means is this.

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.