Commercial real estate crisis is intensifying with $1.5 trillion in loans set to come due, putting lenders at risk.

$1.2 trillion of commercial mortgages are scheduled to mature this year and next, leading to refinancing challenges for borrowers.

Occupancy rates are low, leading to potential defaults, plummeting property values, and further losses for banks.

It's All About the CRE Baby

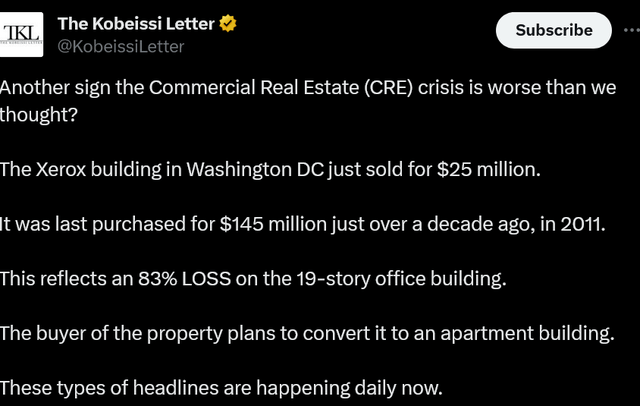

A Tweet from the Kobeissi Letter. I don't know what that is, but the Xerox building in DC just fell 83% over 12 years.

The commercial real estate crisis is finally coming to a head. The NYTimes reports (I'm sorry to link to them, really I am)

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.