Can Unemployment Triangulate The Next (Final) Recession?

There is usually only a few months between when unemployment bottoms and the next recession. It's already been 14 months.

Gold rally in dollars since June 27 looks suspect since open interest has risen too much, too fast, up 70K contracts since bottoming at 440K. Gold could whipsaw here.

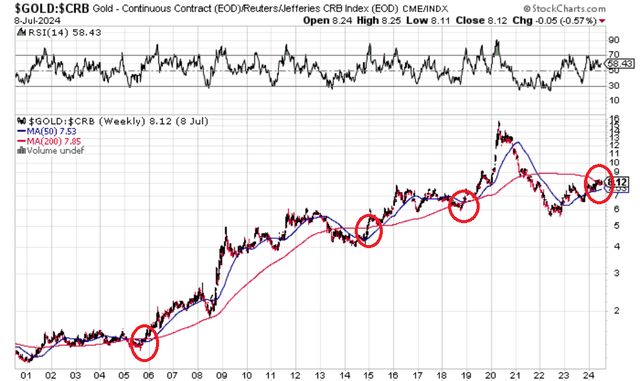

Still, the gold to commodities ratio is now firmly above the 200WMA, meaning we are in the next wave of the gold bull market relative to other commodities.

Repo volume has been above $2T a night since July 2.

Unemployment ticks up to 4.1%. There is usually a buffer of only a few months from when the unemployment rate bottoms to the next recession. It has been 14 months.

Careful of the Gold Rally Since June 27

My gut tells me not to trust this gold rally since June 27. Open interest has risen too fast to right back near local highs. We are at 510K contracts, up from 440K at the June 27 local bottom. This looks like potential whipsawing action up ahead. If you're trading, be careful of chasing here. If you're stacking, there is a bit more time to add to stacks for July.

Even so, we are looking really nice for the true gold bull market, gold relative to other commodities. We are now firmly above the 200WMA in the gold to CRB ratio.

If we can hold this, it would be only the 3rd time we have broken through this level since the gold to commodities bull market began in 2005. To put things in perspective, the only time gold was more valuable relative to commodities than it is now was leading up to, and in the aftermath of, the Covid lockdowns.

So we may be a bit wiggly for another few weeks, but the next leg up is not far off if we look at the previous times the 200WMA was broken through on this ratio.

Repo Volume Has Held Above $2T daily since July 2

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.