Big Trouble In Little China Stock market

And other stories in this week's monetary review from Central Bank funhouse of mirrors that make derivatives look fatter than they appear.

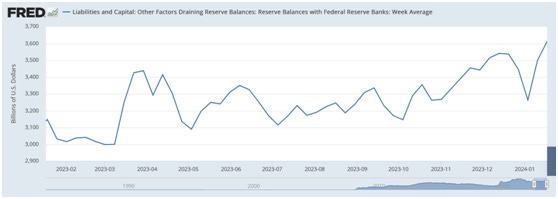

Reserves climb, but bank credit crashing

BTFP spits out another $14.3B, most since April

10Y Treasury shorts at new all time record high, yay

China’s stock market at the apex of a triangle forming since 2007.

China’s central bank finally starts pumping its balance sheet, which it has been conservative above compared to other Western countries.

Reserves Near 2Y Highs, but Bank Credit Crashes by $80B

This is really weird but I think I know why it's happening. Reserves that commercial banks hold at the Fed keep climbing. They're at 2Y highs. Reserves are high-powered dollars that have not been lent out through fractional reserve, so they are just held at the Fed for 5.3% interest.

At the same time, bank credit is crashing. (See below) Bank credit, unlike reserves, is money lent out. If bank credit is contracting, that means more loans are either defaulting or getting paid back than being made. This is despite the strongest January in corporate bond issuance ever. Over $150B in corporate bonds have been issued this month, two thirds of it to banks, which is also padding their reserves.

The money supply will continue to drop to reflect contracting credit, see below.

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.