Beware The Ides Of April, Monetary Plungers Ready

The quarter turn, the bulk of Bank Term Funding loans being paid back, and Tax Day are all happening at the same time, which means liquidity drains from three directions all at once.

The Bank Term Funding Program is starting to be paid back by bailed out banks, causing the monetary base to shrink.

Combine that with the upcoming quarter turn and tax day could this could lead to major liquidity drains and potential funding stresses deep in the plumbing.

The SEC has implemented a new clearing system for the treasury market, which could enhance liquidity but also pose risks if the system clogs or becomes more expensive to use.

Short squeeze in cocoa stalls, but prices head higher anyway, meaning the continuation of the squeeze could really get them moving even faster.

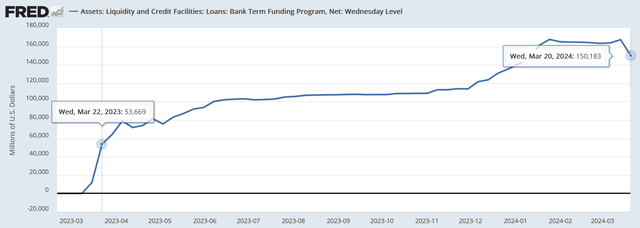

Bank Term Funding Program Starting to Drain

The emergency loans from the Fed are starting to be paid back by the bailed out banks, and as they are, the monetary base is shrinking.

The Bank Term Funding Program fell by about $17B, which is much lower than that $53.669B that were due on March 22, but that's only because of a two day lag. Next week, the fed's balance sheet will drop by another $40B or so in loans plus whatever other QT they are engaging in on a weekly basis.

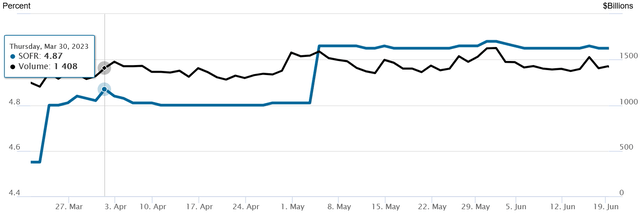

We have the end of the quarter to deal with this week final business day on Friday, so there's going to be some very crowded monetary sewers down there, and something weird could happen. The SOFR market (overnight repo loans) are already straining leading up to the quarter turn, on Friday hitting a volume of $1.85 trillion, and volumes should trend up into the turn.

The chart below is last year's Q1 turn, the blue line the repo rate. You'll notice that it jumped by 7bps. We can expect this to happen again.

At the same time though, we have huge drains from the BTFP, tax day coming up on April 15 which is another huge vacuum cleaner for liquidity, and in the mix on March 29 is delivery day for an active gold and platinum contract.

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.