Banks Splurge On Spot Gold Deliveries Yesterday As We Approach All Time Highs

Yields bounce hard off all moving averages, more signs of "inflation" bottom, gold to S&P ratio approaching apex of giant 23 year old triangle from 2001.

Gold deliveries on Comex were the most yesterday since first notice for the contract. Bullion bank house accounts took 85% of the deliveries, client accounts made 100% of them.

Gold to gold stocks ratio possible head and shoulders top, and 10Y rates bounce off 50DMA, 200DMA, and and 50WMA simultaneously, downtrend break at 4.5%.

Gold to S&P 500 ratio enormous triangle established in 2001, reaches apex.

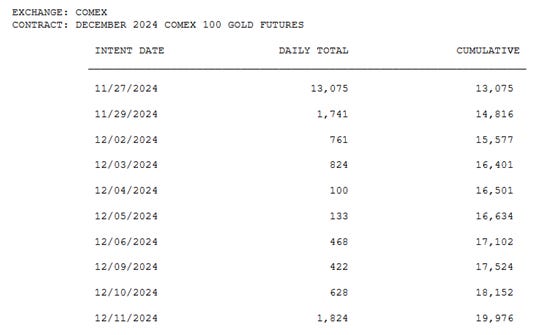

This was unexpected, but always welcome of course. Gold is approaching the $2,800 high, with gold stocks on pace for the level they were at when gold was last at $2,800. One of the proximate causes of yesterday's jump must have been physical demand, at least for Comex warrants on spot gold. There were 2,393 spot contract buys for delivery, and 1,824 warrant deliveries. That's the most since first notice day on November 27.

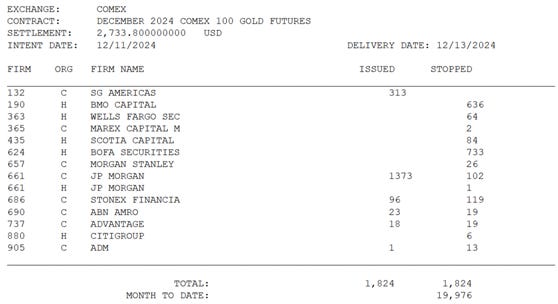

For better or worse, all, meaning 100% of these 1,824 warrant deliveries were issued by client accounts, and 1,524 of the 1,824 deliveries (84%) went to house accounts, meaning to bullion banks themselves. The banks are buying, and they are buying from private sources. The math comes from below. Issued means made delivery, stopped means took delivery. C means client account, H means house:

Gold to Gold Stocks Possible Head and Shoulders Top

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.