Another 34Moz Silver Drained From LBMA In February, Silver Float Down Another 9%

We're on pace for record silver deliveries on Comex, and meanwhile, bond yields are spiking throughout Europe and Japan. That's fun.

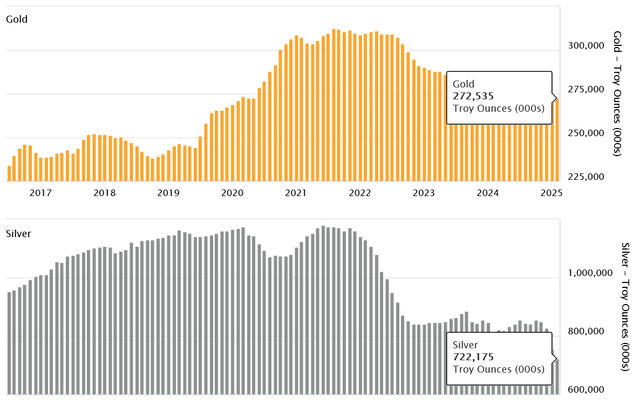

Silver inventories are down another 34,282,000 ounces to 722M. 331M belong to SLV, putting the float down to 391M. Meaning, the float just drained by another 8.7% in February.

The gold float is down slightly to a new post 2020 apocalypse low, but not significantly.

April is Also an Active Gold Contract

We have 17 days until April gold goes to delivery and there are 336,789 contracts still open. This will obviously shrink over the next three weeks but the question is, Is gold delivery demand still increasing? Can we beat the new record of 76,567? So far the answer looks to be yes, and that's because the current contract for March gold, which is inactive, is way ahead of pace to beat the last inactive gold contract of January, which itself had record deliveries for an inactive contract.

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.