30,000 Bullion Bank Short Gold Contracts Have Been Squeezed Since Feb. 4

Gold shorts held by the swaps are down by 30K contracts, while price is up $150 since Feb. 4. It's a small squeeze, but it could soon get much bigger.

TGA Weekly Decline First Time Since Trump Inauguration

The Treasury's bank account [TGA] has declined slightly for the week for the first time since Trump took office. Still, the DOGE cuts keep coming and should help extend the amount of time the government can go without a raise of the debt ceiling.

Strongest QT Since Year End Turn at $31B Last Week

The Fed's balance sheet shrunk by $31B last week, the most in a week since the year-end turn. Half of the loss was in Treasury notes and bondsas usual, and the other half was in "other assets" which means interest paid vs. interest received. Basically the Fed is losing money because it's earning less on its portfolio of treasury crap than it pays in interest to banks for the service of not loaning out their excess reserves and thereby triggering hyperinflation. This loss appears on the balance sheet in the form of "other assets". And it is accelerating the QT process.

The Fed should soon announce a pause to QT until the debt ceiling is raised. Bloomberg is already preparing us for this, noting that a discussion to pause balance sheet runoff is showing up in the Fed minutes. The Fed will need to stop QT before we hit a repo clog, which comes ever closer the lower the balance sheet gets.

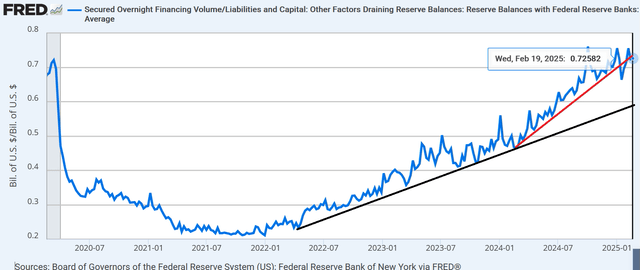

Repo volume appears to be settling around $2.4 trillion a day now. That puts us at 73% in repos to bank reserves ratio, critical being around 83-85% or so. Here's the latest graph of the ratio so you can see where we are on the trajectory.

We are still on the trend line since February 2024 (red line). If we continue on it, we should be only a few weeks away from 83%. If they pause QT, we are likely to slow down the rate though.

Bullion Banks Getting Squeezed on Gold

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.