19 Weeks To Repocalypse? Let's crunch the numbers

As we get closer to the final monetary toilet clog, I think I can use narrower time units from months to weeks. I think we're around 19 of them. Here's why.

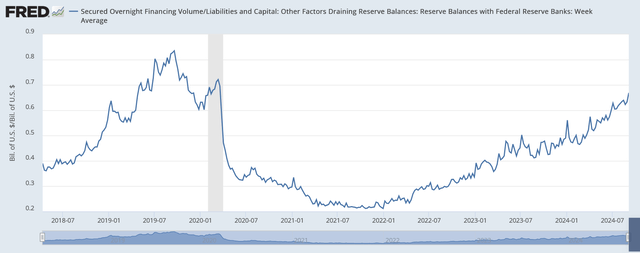

We're At 68% Repos to Reserves, 15.5% Left to the Clog?

The chart above shows the progression of the repo-to-reserves ratio, now at 68%. Below is repo volume, which exploded two days ago by nearly $400 billion to a new high of $2.403 trillion.

I was expecting a major spike in volume for the month turn but not that high. We have since settled back down to $2.205 trillion today, but volumes will continue trickling higher as QT continues and the monetary base shrinks. Reserve balances are now $3.243 trillion, putting the repo to reserves ratio at 68%. We probably need to get to somewhere in the mid 80% range to see fireworks. The ratio chart above has the peak at 83.5%. That's 15.5% away from where we are now, and we have moved exactly that much in 19 weeks.

Assuming the rate doesn't change much, that's about how much time we have until the plumbing clogs up. The rate could slow of course, but consider that it hasn't slowed down since QT slowed down as of the beginning of June, which is when the Fed announced it would curb the pace of balance sheet shrinkage. The ratio climbed

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.