150-Year Gold Trend Line Broken To The Upside

Charts up the wazoo today. How's your wazoo? What even is a wazoo? Does anyone even know?

Gold Uptrend Line Since The Greenback Broken

The chart below has gold up to January at $2,812. We are now at $3,050, so this uptrend line from the Greenback Era of the 19th century and tagged in the 1980 high, has now been broken. Hat tip Ronan Manly.

150 year patterns don't break often. The End Game has got to be close.

The same chart in silver shows the trendline break would be at around $150 or so, but hard to tell since this is logarithmic.

8 Days to Gold Delivery, 253,152 Still Open

The new record is 76,567 contracts delivered. We could break that record for April gold, and judging by the renewed surge of gold into the Comex yesterday, we might. Another 660Koz of gold came into Comex vaults yesterday, so while there was a pause to the inflow, it is now continuing. The registered gold supply for sale against contracts is now at a new record high.

Meanwhile, the strength of the silver flow into New York has not abated at all. We are now just short of 450Moz with about 3Moz coming in every day now.

We also have a strong platinum flow into Comex.

Not a record yet but getting close, and someone bought 400 spot contracts of platinum yesterday for delivery. Someone is interested in physical platinum as well it seems.

Turkey Hyperinflation Resumes

The Turkish lira has collapsed overnight from about 36 to 40 per dollar. They're blaming Erdogan arresting his political rival, the mayor of Istanbul (not Constantinople) but that's just a catalyst. The lira is constantly weakening against the dollar and has these big waterfall declines every now and then towards oblivion. This is just another one of those leaps, the third since 2022.

Turkey's 10Y bond also plummeted and rates jumped a full percentage point.

In further proof that central bank gold reserves do not stabilize a currency if the currency is not convertible, Turkey's gold reserves are at an all time high. Woopdeedoo.

Gold to S&P 500 Ratio Pulling Away

We are at 0.542. We're starting to pull away now as we've broken through the 4 year resistance.

Gold to commodities is at an interesting trend line if we exclude the lockdowns when oil went negative.

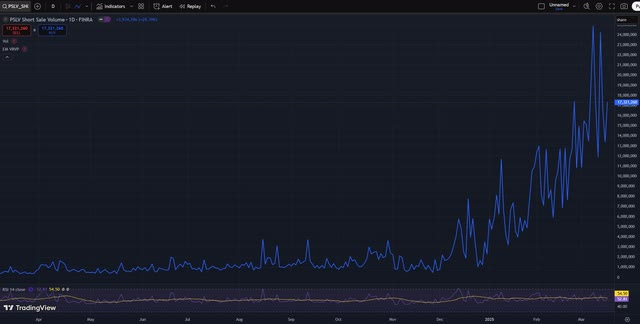

PSLV Short Volume Still Extreme

Whatever is going on in PSLV is continuing. Below is the short volume, still 17M shares.

Total volume is still extreme at 40M shares yesterday.

Shorting continues in SLV as well, with the borrowing rate for shares settling at 2.22%, still way above the normal level of about half a percent.

Japanese Yields Breaking Out

Japanese 10Y yields are already breaking out, and this is Bloomberg on the current situation:

BOJ’s plan to almost halve its bond purchases from July 2024 to March 2026, which will result in its holdings dropping by ¥37.6 trillion next fiscal year. This bodes ill for Japan’s bonds just as the BOJ also plans to raise interest rates further at some point to rein in inflation, and Prime Minister Shigeru Ishiba seeks to shore up his falling popularity with additional spending plans in an extra budget.

At $33/oz, silver still seems to be valued as an industrial metal rather than a monetary metal, although the wholesale movement and physical delivery of millions of ounces of silver between markets and across oceans suggests preparation for a monetary emergency. On the other hand, the silver price appears calm and stable. Will a price break be the first indication of genuine market stress?

Hey Raffi, this may be off-topic, but I have been curious. If you decide to leave Substack, etc., after the endgame hits and we all move on is there any possibility of purchasing some of the artwork that you use on the background of your YouTube videos?